foreign property inheritance tax - uk inheritance tax non domiciled : 2024-11-01 foreign property inheritance taxUsually, there’s a very simple answer, which is that you do not pay tax on the receipt of a foreign inheritance. In general, the U.S. does not tax an inheritance solely because it is . foreign property inheritance taxekoshop.lvlv atsauksmes un apraksts Salidzini.lv lapā. Vērtējums 3.9 no 5. ekoshop.lvlv. 3.9. Atsauksmes 3. . varat ziņot pārkāpumu Patērētāju tiesību aizsardzības centrs. Atsauksmes 3. 5 ★ 100%: 2018-12-18 pul***@inbox.lv. Liels PALDIES. 2018-09-27 Ilo** Jar** Ātri, kvalitatīvi un operatīvi izpildīja pasūtījumu

2,055 reviews. #103 of 248 hotels in Las Vegas. Location. Cleanliness. Service. Value. El Cortez Hotel and Casino is the longest continuously-running casino in Las Vegas. Located off the strip in Fremont East Entertainment District within the historic Downtown, El Cortez is the authentic Vegas experience that you have been craving.

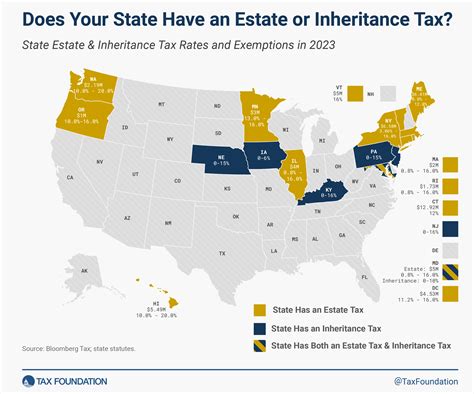

foreign property inheritance taxInheritance Tax (IHT) is paid when a person's estate is worth more than £325,000 when they die - exemptions, passing on property. Sometimes known as death duties.If you are a U.S. person who received foreign gifts of money or other property, you may need to report these gifts on Form 3520, Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Form 3520 is an information return, not a tax return, because foreign gifts are not subject to income tax. However, there are significant .

foreign property inheritance tax

Jan 23, 2024 — Similarly, if you win property in a lottery, you are considered to have acquired this prize at its FMV at the time you won it. Generally, when you inherit property, the property's cost to you is equal to the deemed proceeds of disposition for the deceased person. Usually, this amount is the FMV of the property right before the person's death.Jun 22, 2024 — Introduction to Inheritance Tax in Thailand. Inheritance tax in Thailand, introduced in 2016, applies to both Thai nationals and foreigners. The tax is levied on the transfer of assets, including property, to heirs. This act applies to both Thai nationals and expatriates, with the tax levied on the value of inherited assets exceeding 100 .Nov 8, 2010 — when assets are ‘excluded property’ — some foreign property is excluded property; Calculating the Inheritance Tax exit charge. The calculations for the Inheritance Tax exit charge are .Jun 1, 2023 — We outline some of the complexities of foreign inheritance tax you should watch out for. Foreign inheritances are becoming increasingly common in Canada. . You would need to declare a foreign inheritance of property with a cost of $100,000 or more, on form T1135 (this also applies if the gift brings your cumulative foreign property to over .The Foreign Inheritance Tax (FIT) is a tax that is imposed on the estate of a US citizen or resident who dies while living abroad. It is generally imposed on the value of an estate or inheritance that is received by outbound US persons in excess of $60,000 per year.

Misija. Mēs strādājam klientu labā, lai nodrošinātu vides efektīvu inovatīvu un ergonomisku. iekārtojumu darbam, mācībām un ikdienai. Mēs gādājam par klienta biznesa veicināšanu un. darba procesu veiksmīgu risinājumu. Vīzija. SIA „Daiļrade EKSPO” ir uzticamākais sadarbības partneris un līderis biroja preču apgādes.

foreign property inheritance tax